China’s Love-Hate Affair with US Treasuries Is Cooling Off

We all know that the best time to sell anything is when there are buyers knocking at your door. Because when there’s no one knocking, the prices you secure might be lower-than-desired.

China must be particularly pleased then. Because since this year began, the US Fed has been flooding the world with cash, about US$ 4,500 billion of it. As a comparison, in the wake of the Lehman Brothers collapse, the US Fed flooded the world with about US$ 8,000 bn of liquidity.

It does this by buying up Treasury securities (US govt bonds) from the market. China took the opportunity and sold, according to Chinese portal Sohu a few days ago.

This has led some to conclude that China is raising the current US-China tension through this action. The argument goes that selling Treasury securities would lead to lower prices. With lower bond prices, US interest rates would go up. Higher interest rates would hurt the US economy. That, according to the argument, was the reason.

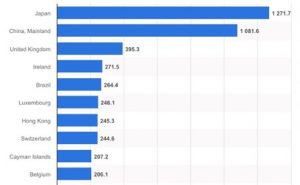

Top Ten Holders of US Treasuries (Mar 2020)

Supporters of the Chinese move would say that there was a fear of negative US interest rates. Therefore, selling US Treasuries is the right move.

On top of that, there was a threat in early May by some US officials to cancel the debt obligations to the Chinese. They want to use the money to pay for the Covid-19 disaster. In other words, the US could tell the Chinese that their US$1 trillion Treasuries will not be returned. It’s better to get rid of these ransomable assets.

The truth is probably slightly different from the two weak reasons painted above. China still holds a lot of Treasuries. The latest official figure is US$ 1,081 billion for March 2020. China is the world’s second-largest holder of Treasuries. Other countries come far behind.

So it would be foolish of China to sell Treasuries aggressively and lower the prices in the process. Because it still holds about US$1 trillion worth of it.

But if one looks at the longer-term view, a trend is emerging. China’s love affair with Treasuries is cooling off. It is getting rid of its Treasuries without trying to affect the prices. It’s just like one lover to an affair planning for alternatives, before announcing the split.

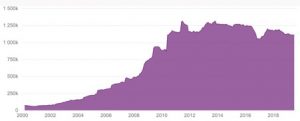

China’s peak holding was in November 2013, when it held US$ 1,316 bn worth of Treasuries. Then, it was the world’s largest holder of Treasuries. This position has since been taken over by Japan.

China’s holdings of US Treasuries (2000 – Mar 2020)

One may well ask: why did China buy Treasuries from the US, its current arch-rival, in the first place? Well, way back in year 2000, when the love affair was blossoming, China was also revving up its export-based economy. This meant it received US dollars for the exports it sold.

These US dollars that China received had to go somewhere.

Treasuries was the easy answer. No other country offers such liquid assets. Buying Treasuries was another way of keeping the renminbi from strengthening. As an export economy, it is important that the renminbi be kept from strengthening to make Chinese export prices competitive.

And so twenty years later, China’s Treasury holdings rose from US$ 58 billion in the year 2000 to US$ 1,081 bn today.

In any relationship, there are downsides too. For China, buying up Treasuries means keeping the US dollar strong and popular. And the strength and popularity of the dollar have been used by many US administration to bully other nations.

For instance, because of the popularity of the US dollar, the US has used the global system of transferring money (SWIFT) to impose sanctions on other countries.

And because the US dollar is the reserve currency of the world, the US administration has repeatedly printed US dollars to pay for its wars against other countries.

Torrid nights before the split

These two key abilities, which the US administration has used often, are being used on China and her trading partners. It’s a love-hate relationship. What can China do about it?

The first thing to do is to get rid of the Treasuries, but slowly. This is so that good prices are given. This means it is not smart to sell all immediately.

Last year, China sold off about US$ 110 bn worth of Treasuries. In 2015-2016, China sold off US$ 500 bn of Treasuries. In both instances, Treasury prices did not weaken significantly.

A fair guide is to sell a maximum of US$ 300 bn a year. So, in order to reduce its Treasury holdings, China would need about 4 to 10 years to get rid of its Treasuries.

There are other steps China must take to get itself out of this love-hate relationship with the US and its dollar. But I shall elaborate on these steps in later articles.

For now, it is important to note that the original reason for buying US Treasuries has weakened as the years go by. The Chinese economy has turned from its export-oriented days to one that is more focussed on feeding its domestic economy.

There is less need to keep the renminbi weak to help Chinese exports, and the flow of US dollars from Chinese exports will slow down.

But that’s a few years away. Meanwhile, the Chinese lover must be deft enough to please his/her lover, find an alternative partner, before declaring the inevitable split.