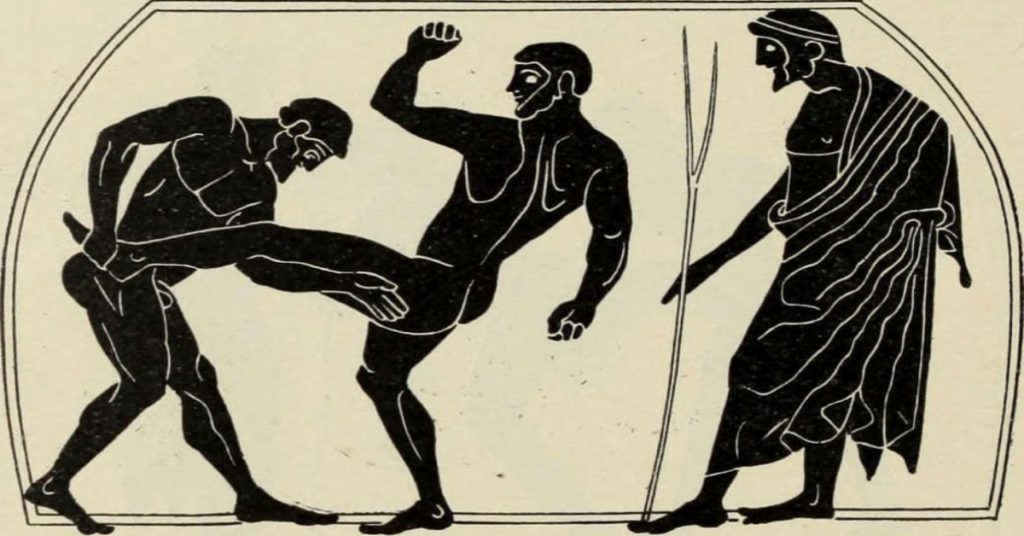

Profiting from this Pankration

Around 648 BC in ancient Greece, there was a very popular and dangerous Olympic sport called pankration. It’s a combination of wrestling and boxing. Everything was permitted except biting, gouging of eyes, nose and mouth, and attacking the genitals.

It was such a deadly sport that one ancient account has it that at the end of a match, the referees couldn’t decide who had won. That’s because both contestants had died from their injuries. So the referees proclaimed the winner as the one whose eyes were still intact.

This ongoing rivalry between the US and China is a bit like pankration. No bullets and missiles have been fired. Probably, there is no intention to squeeze the trigger. But everything else seems permissible.

This past week, in another punch at China, the US Senate overwhelmingly passed a bill that could delist some Chinese companies in the US stock markets. Making this bill into law would take a few more months.

But when passed into law, US-listed Chinese companies would have to be audited to determine whether they are under the control of a foreign (Chinese) government.

So the two big names – Alibaba Group Hldgs and Baidu Inc – could be told to leave US stock markets. This would be inconvenient because US stock markets offer the difficult-to-rival advantages of funding and liquidity for Chinese firms.

The US Senate’s bill didn’t appear overnight. The ball started rolling more than a year ago. It’s supposed to protect US investors. But it was given a boost recently on the back of the Luckin Coffee episode.

A Luckin Coffee shop in China

Luckin Coffee is one of the biggest coffee shop chains in China, rivalling Starbucks in China. It was listed on Nasdaq in early 2019. The price shot up to US$51 per share in January this year before collapsing to less than US$1.50 this past week on news that its earnings for 2019 were falsified.

Not to be outdone, China gave a punch back yesterday with news that it would impose sweeping new security powers over Hong Kong. This is to control the year-long lawlessness in Hong Kong.

Needless to say, the anti-China entities have said and will continue to say that this Chinese move undermines democracy and the rest of the usual neo-liberal statements.

What they will not highlight is that Hong Kong has been part of China since 1997, just as California has been part of USA since 1850. There were similar security laws in Hong Kong under British rule. But they were removed when the British left in 1997.

July 1997: Hong Kong handover

New security powers were supposed to be enacted by Hong Kong policy makers since 1997, while the ex-colony continues to experience its temporary “one-country, two-systems” period. But it has not been done.

With the mess that Hong Kong is going through, China has lost patience and has decided to act. It’s a reasonable gripe. After 23 years, something must be done or that ex-colony will go to pieces.

Certainly, China doesn’t want Hong Kong to go to pieces. It has an important role to play in the long-term China story. China just wants to sort things out. Meanwhile, expect more disruptions and inconveniences as international businesses pull out of Hong Kong.

In ancient Greece, a lot of people profited from the very popular pankration sport, from the referees and female fans, to the sponsors and merchandisers.

In today’s US-China pankration, Singapore could benefit from this rivalry. Sure enough, many Hong Kong residents and businesses have moved their homes and operations to Singapore. But the biggest prize would be Hong Kong’s bustling financial community.

If Chinese firms are not allowed to be listed in US stock markets, and they wish to be outside China, the second-choice alternative has traditionally been Hong Kong. But with Hong Kong in such a sorry state, the third-choice alternative is Singapore.

London would be a great alternative. But there are concerns that the British government would take the neo-liberal position.

Many years ago, Singapore was on the verge of becoming the investors’ gateway to Asia. But when fears of post-1997 Hong Kong reverting back to communism proved unfounded, Singapore slowly lost its attractiveness.

Currently, Singapore is nowhere near Hong Kong in terms of capability and popularity when it comes to the investment industry. In recent years, there have been more de-listings than listings in SGX. Worse, some of our home-grown companies have chosen to be listed elsewhere.

There are many reasons for the decline. Some say our education system does not produce people with the appropriate risk appetite. Some say Singaporeans are too in love with property as an investment. Or maybe the profits and commissions from working in the stock markets are too thin to attract more talented people.

Whatever the reasons, stocks account for less than 10% of Singapore household assets. In the US, the comparable figure is closer to 50%.

This story will not end on a gloomy note. Because there is hope of benefiting from this US-China pankration, if the Singapore government is keen on it.

Singapore’s track record has always been good. It invested billions to nurture industries such as health care, wealth management, and biomedical sciences. It has created an attractive environment for technology start-ups.

So Singapore has a good chance of reviving its investment and stock market industry, provided it fits into the grand plan. Otherwise, we will just see this opportunity slip by. At least we have the grandstand seats. We have the next decade to watch Hong Kong rise again, because it has so many advantages of being in China.